Your Trusted Florida Mortgage Lender

Financing

3.5% Down

Properties

Fast Closings

New Home Purchase or Refinance?

We've Got You Covered!

PREQUALIFY - APPLY IN MINUTES

Trusted Florida Mortgage Lender

Our Florida Rates

Rates current as of 10/16/2017, 2:56:53 PM . *Rate Assumptions

Your Florida Mortgage Experts

1st Florida Mortgage is an upfront mortgage lender for new home loans and mortgage refinance. As a local lender we can provide a level of customer service that is second to none. We are a technology driven company and offer a streamlined home buying process, low rates, low fees, and can close loans fast.

VA, FHA and USDA approved lender in Florida. Whether you are purchasing or refinancing we have you covered. Our friendly loan officers are here to help and we will be with you all the way from application to closing. Jump in front of the line and apply online today!

1st Florida Mortgage

Close on Time

Our goal is to close every loan in 28 days or less. In-house underwriting, processing and closing for fast approval & on time fundings.

Low Rates & Fees

Florida Mortgage Company with Low Mortgage Rates.FHA, VA, and USDA Approved Lender.

Customer Service

Local Florida mortgage lender with local customer service. We will be with you every step of the way from application to closing.

FHA Loan Advantages

- Great 1st Time Buyers

- Low Down Payment

- Easier Credit Qualifying

- 203K Renovations Loan

VA Mortgage Advantages

- Zero Down, 100% Financing

- No Monthly Mortgage Insurance

- No Debt to Income Restrictions

- Jumbo Option with Down Payment

Conventional Fixed Loans

- Primary, 2nd homes and Investment

- Up to 97% Financing

- No Up-front Funding Fees

- Renovation Loan Programs

USDA Mortgage Advantages

- 100% Financing Rural Properties

- Primary Residence Only

- Closing Costs Rolled In

- Repairs Can be Rolled In

Florida Mortgage Lender | Local Customer Service

Direct Florida mortgage lender with in-house underwriting which means we can make decisions fast and close your loan fast – typically in 28 days or less. 1st Florida Mortgage is your local mortgage company for new home purchases and mortgage refinancing: Florida FHA, Florida VA Loans, USDA Loans and Jumbo Loans,

Low Rates, Customer Service and Upfront Lending is our motto and is why more Floridians are choosing 1st Florida Mortgage as their preferred mortgage lender in Florida. We have experienced Florida mortgage loan professionals on standby to help answer any home lending questions that you may have. We promise to make the whole mortgage process as stress free as possible.

As a technology driven mortgage company our borrowers are always top of mind for everything we do, from our web friendly application to our automated alerting system as your loan moves through the pipeline. You will be updated as your loan moves through the process every step of the way. It’s this continued level of commitment to customer service that has made us a top mortgage lenders in Florida. 1st Florida Mortgage is a DBA of MiMutual mortgage with offices in Michigan, Texas and Florida.

1st Florida Mortgage – Trusted Florida Mortgage Lender

At 1st Florida Mortgage (a MIMutual Mortgage company) we believe that the process of obtaining a home mortgage should be streamlined and hassle free. As a technology driven company we can process mortgage loans quickly- 1st Florida Mortgage knows your time is valuable, our goal is to make your home loan experience simple and as painless as possible. Whether a FHA loan, VA loan for our US veterans, or USDA home loans, we can structure the perfect home loan for your individual needs.

We are a direct mortgage lender in Florida for new home purchases and mortgage refinance. Let our Florida loan officers answer your questions and provide you with a no cost loan estimate. Apply Online in Minutes or Call (407) 392-4031 .

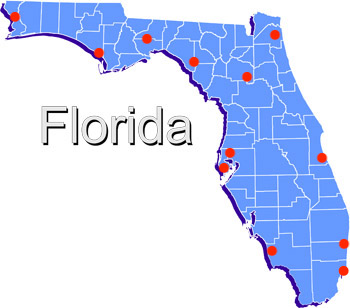

Florida Mortgage Company

Helping Open Doors Since 2007

Headquartered in Tampa, FL we are right around the corner and can close loans anywhere in the state of Florida. As a direct lender we can offer in-house underwriting and processing not available to traditional mortgage brokers. That means we can close loans fast!

We strive to close all loans in 28 days or less. Our mission statement is simple: integrity, customer service and upfront lending. It’s this simple recipe has propelled us to one of the top mortgage companies in Florida.

We are an approved Florida lender for FHA loans, VA loans, and USDA loans and specialize in new home purchases. Call to speak with one of our Florida loan officers or jump in front of the line and apply online.

Mario Larrea

Sr. Loan Officer

NMLS #184372

Daniel Neto

Loan Officer

NMLS #155499

Brooke Benson

Sr. Loan Officer

NMLS #409893

Jimmy Smith

Loan Officer

NMLS #2038961

Femi Oriogun

Sales

Manager