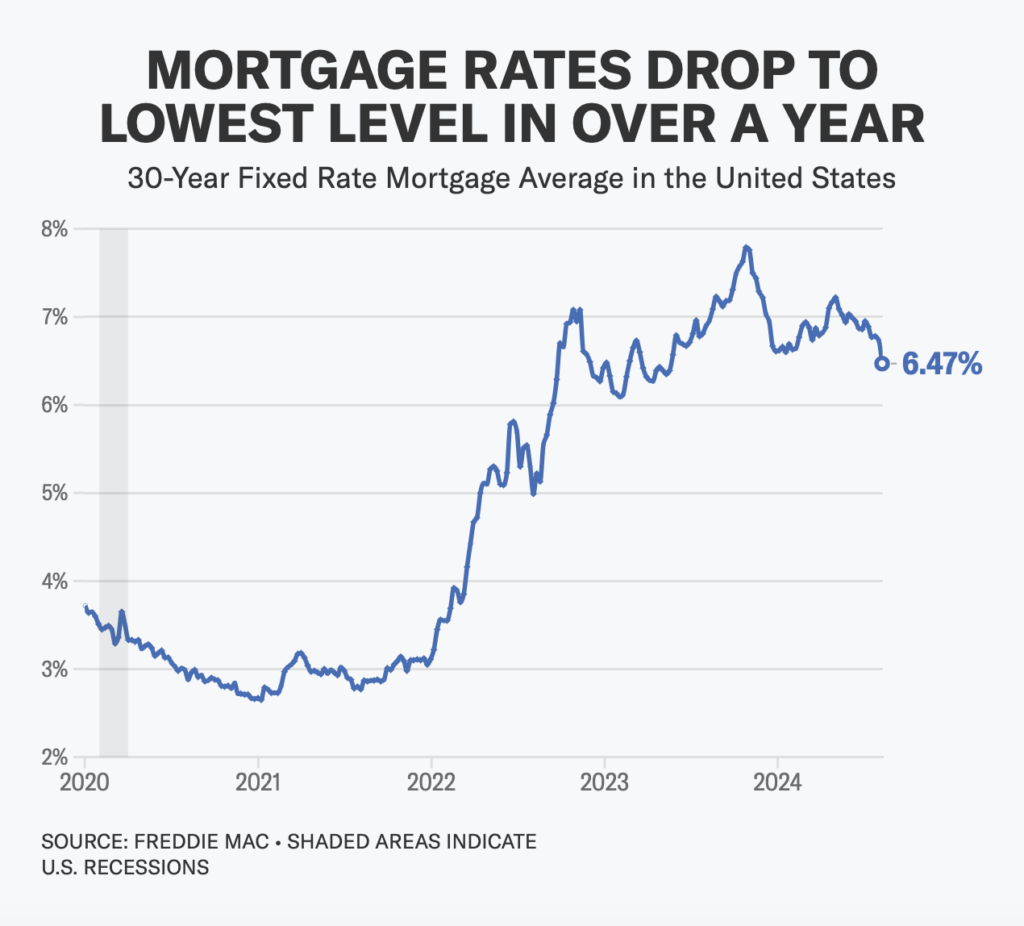

Mortgage rates fell to their lowest level in over a year, a welcome development for the housing market

According to Freddie Mac, the average 30-year fixed-rate mortgage rate dropped to 6.47% from 6.73% last week.

Mortgage rates fell to their lowest level in over a year, which helped boost the housing market.

In the past year, the average interest rate for a 30-year fixed-rate loan was 6.96%.

In addition, the average 15-year fixed mortgage rate declined from 5.99% a week ago to 5.63% this week. 6.34% was the interest rate on 15-year loans a year ago.

It was overreaction to a less-than-positive employment report and turbulence in financial markets that caused mortgage rates to plunge this week, according to Freddie Mac’s chief economist.

A decline in mortgage rates over the last few years has increased prospective homebuyers’ purchasing power and sparked their interest in making a move, according to the economist.

Long-term bond yields have fallen on expectations of a Federal Reserve rate cut in September, which in turn has pushed down mortgage rates.

Buying a home has also become more affordable due to the drop in rates. While home prices reached a new high in June, existing home sales slowed, and there are signs that buyers are returning to the market.

In his view, a balanced market condition is on its way, according to NAR chief economist Lawrence Yun. Although the housing market is entering a slower season, buyers are still on the sidelines as the seller’s market shifts to a buyer’s market. Even though interest rates dropped last week, mortgage applications only increased by 1%, and there were 11% fewer applications than a year earlier.

“According to Joel Kan, VP and deputy chief economist at the Mortgage Bankers Association, purchase activity only saw small gains despite the downward movement in rates. According to a press release published on Yahoo Finance, conventional purchase applications were offset by government purchase applications. In some parts of the country, there is a gradual increase in inventory, and homebuyers might wait for lower interest rates before buying, Kan said.

As a result of falling interest rates, Goldman Sachs analyst Vinay Viswanathan revised up expectations for home price appreciation this week. In 2017, the price increase was forecast to be 4.2%, and in 2018, it was forecast to be 3.2%. The Mortgage Bankers Association also reports an increase of 16% in mortgage refinance applications over the previous week, as rates fall.

Check out 1st Florida Mortgage today’s rates for VA home loans, FHA and Conventional.