KEY TAKEAWAYS

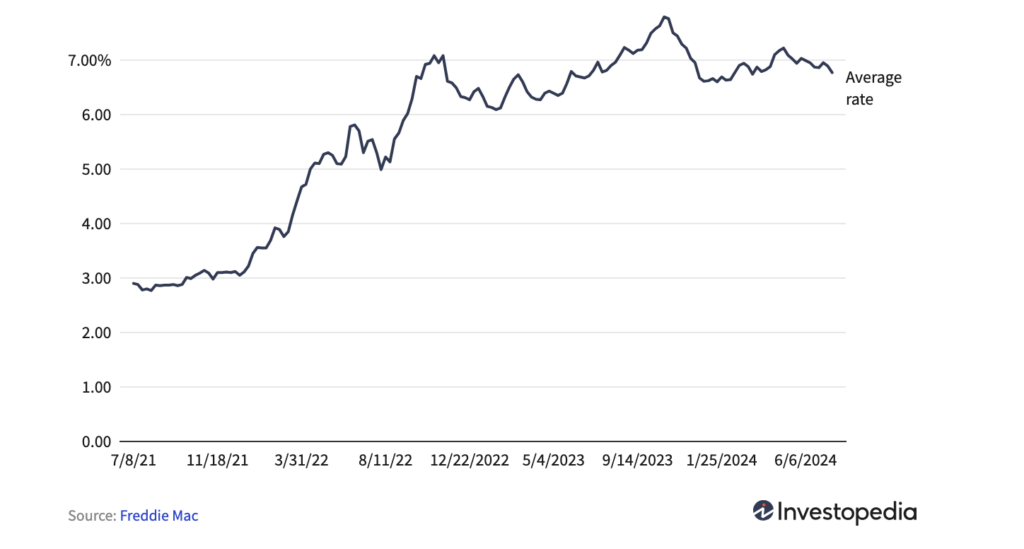

- According to Freddie Mac – rates fell again for second week in a row and saw the lowest rates since mid-March

- Inflation numbers improving, but rates remain elevated as the Federal Reserve continues its fight against inflation.

- Economists predict that mortgage rates likely to remain above 6.5% for the next 12-18 months.

Average mortgage rates in Florida fell to their lowest level since mid-March this week.

According to Freddie Mac, the average interest on a 30-year, fixed-rate loan is 6.77%, down 12 bps from last week.

The mortgage rates in Florida have been trending down since early May, despite a couple of bumps here an there. They’re far lower than the high rates we saw last fall but are still 4 points higher than the ultra-low rates we saw in the early months of the pandemic.

Mortgage Rates Trickle Downward, But Still Elevated

The average mortgage rate on a 30-year, fixed-interest loan as measured by Freddie Mac fell for the second week in a row but is still far from the pandemic-era lows.

The recent downward trend in mortgage rates is encouraging news for homebuyers who have been hindered by high rates, according to Michael Underwood at the Underwood Team in Tampa, FL.

Why the High Mortgage Rates ?

With the Federal Reserve fighting inflation with high interest rates, the housing market has been stymied for more than two years. There are many factors that affect mortgage rates.

The Federal Reserve has raised the fed funds rate to 23-year highs and kept it there for the last 12 months in an effort to limit price increases. A significant influence on mortgage rates is the fed funds rate and the yield on 10-year Treasury bonds. Due to those factors, home loan rates have fallen as the Federal Reserve prepares to cut interest rates.

Florida mortgage lenders expect the markets to slowly rebound however, economists predict that interest rates will likely remain above 6.5% through the end of the year and likely into 2025. Because of the rising rates, potential buyers are likely to stay away from buying houses, while sellers are likely to remain reluctant to list their homes for sale.